COVID-19 Legal Insights

COVID-19 Legal Insights

The full impact of the COVID-19 coronavirus pandemic on the construction industry remains uncertain. Construction contractors are facing challenges both common to all businesses and unique to the construction industry. Contractors have questions essential to operating their companies successfully and legally in the new COVID-19 environment, particularly regarding employment issues, continuation of construction work, and their rights and liabilities in the event of disruptions, delays, and suspensions.

Enactment of the Families First Coronavirus Response Act and the Emergency Paid Sick Leave Act, effective April 1, 2020, established a new set of rules governing how all businesses with under 500 employees are to handle sick leave and family leave. We are here with answers to the most asked employment related questions posed by contractors and to provide you with information, insights and guidance on proceeding with construction projects and contract issues.

COVID-19 RESOURCE SECTIONS

General COVID-19 Labor and Employment Questions & Answers [Click Here]

OSHA Provides Guidance to the Construction Industry on how to Address the COVID-19 Hazard

Paycheck Protection Program Replenished [Click to view additional details]

OSHA Supplements COVID-19 Guidance for the Construction Industry

Significant Changes to the Forgiveness of PPP Loans Under The Cares Act

Coronavirus E-blast - EEOC Issues New Technical Assistance on COVID-19

WEBINARS & PODCASTS

The Roofer Show Podcast #158: "Families First Coronavirus Response Act: What You Need To Know”

The Roofer Show Podcast #159: “Cash Is King: How To Get Paid”

Webinar for Chicago Roofing Contractors Association - Webinar available in Members Only section

VALUABLE LABOR & EMPLOYMENT COMMUNICATIONS TOOLS

CONSTRUCTION HALL PASS

Download a letter of authorization (i.e. “Hall Pass”) your employees can carry when traveling to and from worksites.

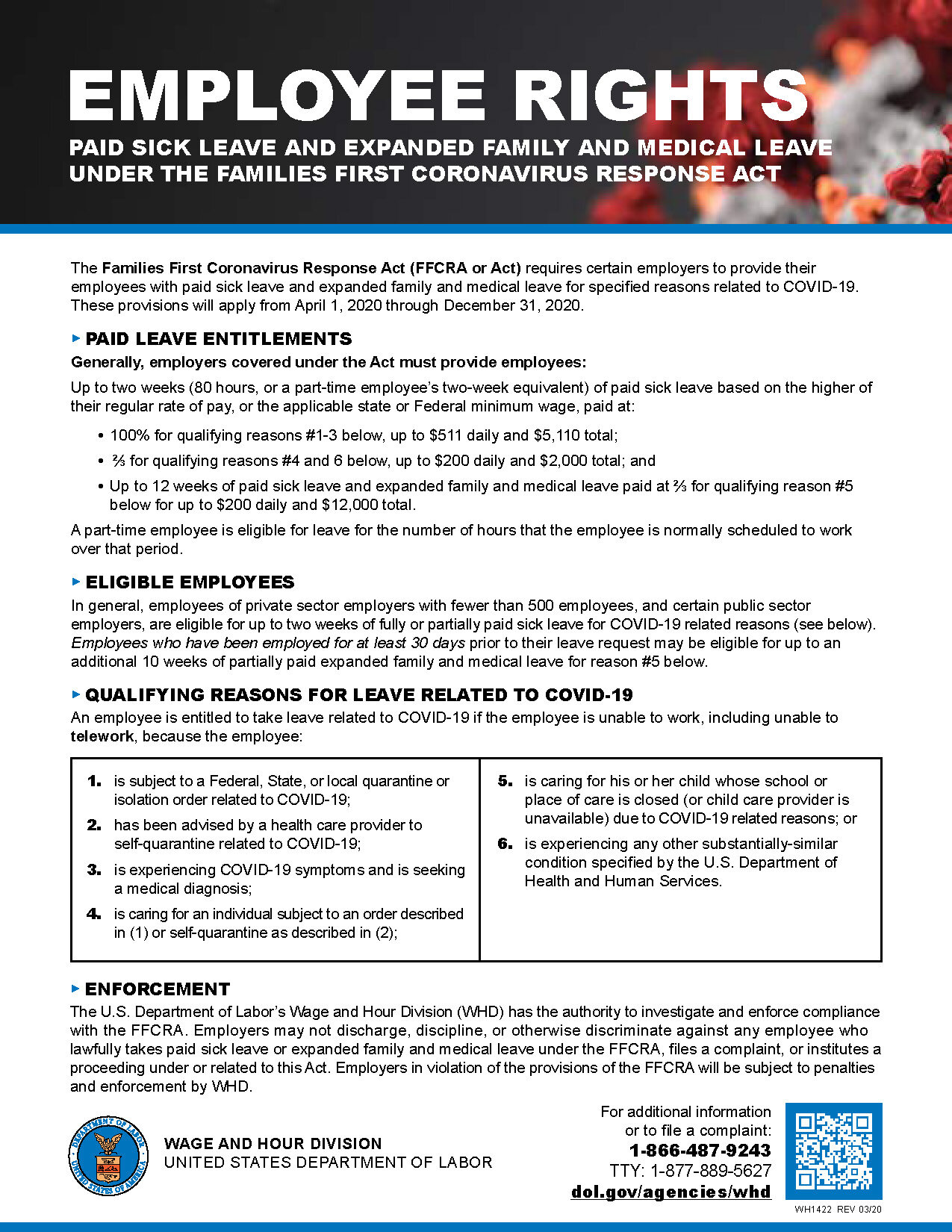

DEPARTMENT OF LABOR NOTICE POSTER

Download the notice to employees’ poster the Federal Department of Labor requires employers to display pursuant to the Families First Coronavirus Response Act.

COVID-19 Labor and Employment Issues - FAQ's

COVID-19 Labor and Employment Issues - FAQ's

The impact of the COVID-19 coronavirus pandemic on the construction industry, your jobs, and your employees is unknown.

We know you are facing labor and employment related issues, and we are here to answer your questions.

We have put together answers for many of the most pressing labor and employment related questions we have been receiving. The Q&As are below.

Please note: if you have a company handbook, we suggest you first consult and follow your company’s policies as published in your company handbook. Do not hesitate to call or email us with any additional questions.

We will be here for you throughout this pandemic. Stay safe.

Can we restrict business travel and require employees to work from home?

Yes. Whether your company chooses to restrict travel is up to you. Restricting travel may have the effect of leaving some of your employees without any work. Whether you are legally required to pay those employees while they are not working is a question we answer below. Of course, those employees who continue to work from home will be due to be paid.

We have employees who are fearful of the virus and don’t want to come to work. Do we have to pay them for the time they are away from work?

Absent an employment contract with the employee or an applicable collective bargaining agreement that addresses this subject, the answer for your non-exempt, hourly paid employees is likely no. Under the Fair Labor Standards Act (“FLSA”), minimum wage and overtime pay for your non-exempt, hourly paid employees are dependent on hours actually worked in a work week. Non-exempt, hourly paid employees who are not working are not entitled to wages.

But what about exempt, salaried employees? If an employee is a salaried exempt employee, the employee must be paid if the employee performs any work during the work week, but the law allows you to make certain deductions from an exempt employee’s salary without jeopardizing the exempt status of the employee. If the employee is not sick but chooses to stay home from work for a full day, you are permitted to make a deduction from the employee’s salary for the one day absence. The law allows you to make a deduction for a full day absence for personal reasons, other than sickness or disability.

If an exempt, salaried employee chooses to stay home for an entire week and performs no work during the week, you may withhold the employee’s salary for the week.

If an employee decides to stay home to avoid getting sick, can we count these absences against any paid leave they may be entitled to? Can we count it as an unexcused absence? Or are they protected absences?

First, consult your company handbook. Any action concerning use of paid leave should be consistent with the company’s policy included in any company handbook. If you have a policy which applies in this instance, follow it. If the policy permits you to require use of paid leave time, then you can follow the policy, although we do caution you to consider the employee morale component of any such decision.

Legally, the FLSA does not require employer-provided vacation time and does not entitle an employee to stay at home to avoid getting sick. In the event that the employee does decide to stay home, the absences will generally not be protected, and you can consider the absence an unexcused absence, although consideration should be given to the effect such a policy may have on employee morale.

You will not be permitted to take adverse action against an employee who refuses to work because they believe an imminent danger exists in the workplace. This is an OSHA issue. OSHA defines an “imminent danger” to include “any conditions or practices in any place of employment which are such that a danger exists which can reasonably be expected to cause death or serious physical harm immediately or before the imminence of such danger can be eliminated through the [OSHA] enforcement procedures.” Unless you have a confirmed or suspected case of COVID-19 coronavirus in the workplace, it is unlikely that such an imminent danger exists that would allow for the employee to legally refuse to work.

Do we have to pay employees if we close the office and the employees are unable to work from home or otherwise not working?

For your non-exempt, hourly paid employees, you do not have to pay them if they are not working, even if they are not working because you closed the office.

As it concerns your exempt, salaried employees, if the office is closed for the entire week and the exempt, salaried employees perform no work during the week, you may withhold paying the employees’ salaries that week. But if an exempt employee performs any work during the week that you close your business, he/she is entitled to his/her full salary for the week.

Please note that the U.S. House of Representatives introduced and passed H.R. 6201, the Families First Coronavirus Response Act, which would amend the FLSA and other employment related Acts. As of writing, the bill has yet to become law (has not been passed by the Senate nor signed by the President). If passed in its current form, the bill would immediately require, among other things, for employers with fewer than 500 employees to provide two weeks of paid sick leave, paid at the employee’s regular rate, if the employee must quarantine or seek a diagnosis or preventative care for COVID-19 coronavirus, comply with a public recommendation or order, or care for or assist a family member due to the COVID-19 coronavirus. The bill would also require paid sick leave at two thirds the employee’s regular rate to care for a family member or care for a child out of school due to the COVID-19 coronavirus.

Can we make employees who are exhibiting symptoms of a contagious illness or the COVID-19 coronavirus go home from work for the day? Do we have to pay them if we send them home?

Yes, you can make employees who are exhibiting symptoms of the COVID-19 coronavirus or a contagious illness go home. Pursuant to the CDC’s Interim Guidance for Businesses and Employers, the CDC recommends that employees who are exhibiting symptoms of a contagious illness or the COVID-19 coronavirus (i.e. cough, shortness of breath) be separated upon arrival to work and sent home immediately. The CDC’s Interim Guidance for Businesses and Employers can be found here: https://www.cdc.gov/coronavirus/2019-ncov/community/guidance-business-response.html. The CDC’s current list of symptoms of the COVID-19 coronavirus can be found here: https://www.cdc.gov/coronavirus/2019-ncov/symptoms-testing/symptoms.htm.

Whether you have to pay the employee who is sent home during the day is a function of whether the employee is an exempt, salaried employee or a non-exempt, hourly paid employee. For the exempt, salaried employee, you are not permitted to make any deduction from the employee’s salary because the situation does not involve a full day absence from work. You are under no obligation to pay the non-exempt, hourly paid employee after they are sent home from work.

If the exempt, salaried employee remains out of work for full day absences due to his or her sickness, the law only permits you to make a deduction from the salaried employee’s pay without jeopardizing the exemption if the deduction is made in accordance with a bona fide plan, policy or practice of providing wage replacement benefits for such absences.

Whether your situation involves either a non-exempt, hourly paid employee or an exempt, salaried employee, be sure to consider your obligations under the Americans with Disabilities Act and Family Medical Leave Act, if any, if the employee requires extended time away from work.

Our business is suffering as a result of the COVID-19 coronavirus, and we are unable to keep our employees fully employed. Are we permitted to lay off employees until we recover from the fallout surrounding the virus? For employees that are laid off, can we continue to require them to pay the employee portion of their health insurance premiums?

Certainly, lack of work is a non-discriminatory, legitimate business reason for laying off employees, reducing hours, or terminating employees. Be mindful, however, that while it is well known that terminating an employee’s employment will allow the employee to claim unemployment benefits, a layoff or reduction in hours may also entitle your employees to unemployment benefits in your state.

Moreover, in addition to terminating the employment relationship, laying off an employee or reducing an employee’s work hours may be a triggering event under COBRA. A reduction in hours will also constitute a qualifying event if the reduction in hours has the effect of excluding the individual from coverage under the terms of the plan. If the reduction in hours has no effect on the employee’s coverage, it is not a COBRA event and you can still require the employee to pay the employee portion of the premium.

Can we take an employee’s temperature at work to determine whether the employee might be infected?

It depends. The Americans with Disabilities Act (“ADA”) considers taking an employee’s temperature as a “medical examination,” and prohibits employers from requiring medical examinations unless the employer can show (1) that the medical examination is job related and consistent with business necessity, or (2) the employer has reasonable belief that the employee poses a “direct threat” to the health or safety of the employee or others which cannot be eliminated or reduced by a reasonable accommodation. A “direct threat” is defined as there being a significant risk of substantial harm. In the event that the COVID-19 coronavirus is or becomes widespread in your community as assessed by the CDC or state or local health authorities, and you have an employee exhibiting symptoms of the COVID-19 coronavirus consistent with what is being reported, then you may take an employee’s temperature.

If an employee has been absent from work, can we ask why the employee has been absent?

Yes. An employer may ask an employee why the employee did not report to work. It is not a disability-related question protected under the ADA.

Example: During the COVID-19 coronavirus pandemic, an employer directs a supervisor to contact an employee who has not reported to work for five business days without explanation. The supervisor asks this employee why he is absent and when he will return to work. The supervisor’s inquiry is not a disability-related inquiry under the ADA.

If an employee has been absent from work because the employee has been sick, can we require the employee to provide a doctor’s note or release before returning to work?

Yes. Such a request would be permitted under the ADA either because it would not be a disability-related request or because the employee poses a “direct threat” to the health or safety of the employee or others. You can ask the doctor to state the employee is not contagious or otherwise have the doctor identify any workplace modification that may be needed to protect the health and safety of others. The note should not provide a diagnosis, however.

Does any of this implicate OSHA?

Yes. You do have a legal obligation under OSHA to keep your workplace safe from known hazards your employees will be exposed to in the performance of their duties. In this instance, OSHA has published a guide that provides steps companies can take to meet their obligations under OSHA and protect their workplace. You can access OSHA’s publication on the COVID-19 coronavirus at: https://www.osha.gov/Publications/OSHA3990.pdf.

FAMILIES FIRST CORONAVIRUS RESPONSE ACT: LABOR AND EMPLOYMENT FAQ's

FAMILIES FIRST CORONAVIRUS RESPONSE ACT: LABOR AND EMPLOYMENT FAQ's

March 20, 2020 Memorandum

On Wednesday night, after being passed earlier in the day by the U.S. Senate, President Trump signed into law the Families First Coronavirus Response Act (the “Families First Act”). The Families First Act was the second in what is expected to be a series of pieces of legislation designed to address the COVID-19 coronavirus pandemic. The Families First Act contains a number of employment related provisions that will have a direct impact on employers with fewer than 500 employees.

On March 18, 2020, we published and distributed a memorandum containing answers for many of the most pressing labor and employment related questions that we have been receiving. This memorandum supplements our March 18, 2020 memorandum and is intended to address and answer questions about the provisions related to the new labor and employment obligations under the Families First Act. Guidance documents and implementing regulations are expected from the Department of Labor as well as from other federal agencies. We will continue to update our clients as more information becomes available. This memorandum focuses on what our clients need to know about the version of the Families First Act signed into law on Wednesday night.

Please do not hesitate to call or email us with any additional questions you may have. We will be here for you throughout this pandemic. Stay safe.

What are the provisions of the Families First Act that impact employers?

The Families First Act contains two primary provisions that impact employers. The first provision is the Emergency Paid Sick Leave Act (“EPSLA”), which requires certain employers to provide paid sick leave to employees who are unable to work because of COVID-19. The second provision is the Emergency Family and Medical Leave Expansion Act (“EFMLA”), which expands the Family and Medical Leave Act (“FMLA”) and also requires certain employers to provide leave, as well as pay, to eligible employees.

Emergency Paid Sick Leave Act (“EPSLA”)

Which employers are subject to the paid sick leave provisions?

If you employ fewer than 500 employees, you are subject to the law. Private employers with fewer than 500 employees will be required to give paid leave to eligible employees.

Which employees are eligible for paid sick leave?

If you have fewer than 500 employees, all of your employees are eligible for paid sick leave, regardless of how long the employee has been employed by your company. Employees will be eligible to take paid sick leave if they are unable to work (or telework) and need to take sick leave because of one of the following six (6) reasons:

The employee is subject to a Federal, State, or local quarantine or isolation order related to COVID-19;

The employee has been advised by a health care provider to self-quarantine due to concerns related to COVID-19;

The employee is experiencing symptoms of COVID-19 and is seeking medical diagnosis;

The employee is caring for an individual who is subject to a Federal, State, or local quarantine or isolation order related to COVID-19 or has been advised by a health care provider to self-quarantine due to concerns related to COVID-19;

The employee is caring for a son or daughter of such employee if the school or place of care of the son or daughter has been closed, or the child care provider of such son or daughter is unavailable, due to COVID-19 precautions; or

The employee is experiencing any other substantially similar condition specified by the Secretary of HHS in consultation with the Secretary of the Treasury and the Secretary of Labor.

The amount of compensation an employer is required to pay an eligible employee will depend on which of the above reasons the employee takes sick leave.

How much compensation must employers pay eligible employees for sick leave?

Employers must compensate eligible employees who take sick leave to care for themselves (reasons 1-3) at the higher of: (1) the employee’s regular rate of pay; (2) the federal minimum wage; or (3) the local minimum wage.

Employers must compensate eligible employees who take sick leave to care for others (reasons 4-6) at two-thirds of the employee’s regular rate of pay.

Importantly, there is a cap, or limit, on the amount of wages employers will be required to pay employees for sick leave under EPSLA.

What is the compensation cap?

The compensation cap depends on the reason for the need to take paid sick leave. If the employee is taking paid sick leave under reasons 1-3, EPSLA caps the amount of compensation at $511 per day (with an aggregate limit of $5,110). If the employee is taking paid sick leave under reasons 4-6, EPSLA caps the amount of compensation at $200 per day (with an aggregate limit of $2,000).

How much sick leave can an eligible employee take?

Full-time employees are entitled to eighty (80) hours of paid sick leave and part-time employees are entitled to the average number of hours the part-time employee worked on average, over a two (2) week period.

If an employee’s schedule varies from week to week to such an extent that an employer is unable to determine with certainty the number of hours the employee would have worked if the employee had not taken paid sick leave, the number of hours of paid sick leave should be calculated as the average number of hours that the employee was scheduled per day over the six (6) month period prior to the date on which the employee takes the paid sick leave, including the hours the employee took leave of any type. If the employee did not work over the six (6) month period, the number of hours of paid sick leave should be calculated as the reasonable expectation of the employee at the time of hiring of the average number of hours per day that the employee would normally be scheduled to work. To assist employers in calculating the number of hours of paid sick leave for employees, EPSLA instructs the Department of Labor to issue calculation guidelines “not later than 15 days after the date of the enactment.” The President signed the legislation the evening of March 18, which means that the Department of Labor should issue the calculation guidelines by April 2.

Is the employer required to give notice to employees of the paid sick leave?

Yes. The Secretary of Labor will be making available an approved notice form that must be posted by the employer where notices to employees are customarily kept. When the notice becomes available, we will send out a link via our e-mail blast.

When do the paid sick leave requirements begin?

EPSLA states that the paid sick leave requirements “shall take effect not later than fifteen (15) days after the date of enactment.” The President signed the legislation the evening of March 18, which means that EPSLA requirements become effective April 2.

When do the paid sick leave requirements end?

EPSLA contains a sunset provision that terminates the paid sick leave requirements of EPSLA on December 31, 2020.

What about the employer’s existing sick leave policies?

Paid sick leave under EPSLA is in addition to the employer’s existing sick leave policies. EPSLA states that “[a]n employer may not require an employee to use other paid leave provided by the employer to the employee before the employee uses the paid sick time under [EPSLA].”

Will employers be penalized for non-compliance with EPSLA?

Yes. EPSLA prohibits employers from discriminating or disciplining against, or discharging, an eligible employee who takes paid sick leave or files a compliant or institutes an action related to EPSLA. Employers who do not give an eligible employee paid sick leave or willfully discriminate, discharge, or discipline an eligible employee could be subject to a fine up to $10,000, and/or imprisonment up to six months.

Emergency Family and Medical Leave Expansion Act (“EFMLA”)

Which employers are subject to the leave provisions under EFMLA?

If you employ fewer than 500 employees, you are subject to the law. Private employers with fewer than 500 employees will be required to give paid leave to eligible employees. Please note that EFMLA now drastically changes employer coverage obligations for employers not traditionally subject to FMLA requirements (those employers with 50 or less employees). In addition, EFMLA states that the Secretary of Labor shall have the authority to issue regulations for “good cause” under EFMLA, including “to exempt small businesses with fewer than 50 employees from the requirements of [EFMLA] when the imposition of such requirements would jeopardize the viability of the business as a going concern.” However, as of this writing, the Department of Labor has not issued any regulations exempting employers with 50 or less employees from EFMLA obligations.

Which employees are eligible for leave under EFMLA?

Employees are eligible for leave if the employee has been employed for at least 30 calendar days. Please note that this eligibility requirement varies considerably from the 12-month employment and 1,250 hours requirement usually applicable to FMLA leave eligibility.

In addition, the employee must elect leave due to a “qualifying need related to a public health emergency.” EFMLA states that this means “the employee is unable to work (or telework) due to a need for leave to care for a son or daughter under 18 years of age of such employee if the school or place of care has been closed, or the child care provider of such son or daughter is unavailable, due to a public health emergency.” EFMLA goes on to state that the term “public health emergency” means “an emergency with respect to COVID-19 declared by a Federal, State, or local authority.”

How much leave is an eligible employee entitled to under EFMLA?

Eligible employees will be entitled to twelve (12) weeks of job-protected leave. EFMLA does not expand the standard twelve (12) week per twelve (12) month standard leave requirement under the FMLA.

How much compensation must employers pay eligible employees for leave under EFMLA?

Importantly, the first ten (10) days of leave under EFMLA are unpaid. During this first ten (10) day period, an employee may choose to substitute any accrued paid leave (such as vacation or sick leave) to cover some or all of the ten (10) day period. However, an employer must pay an eligible full-time employee for each day of leave after the initial ten (10) days “in an amount not less than two-thirds of an employee’s regular rate of pay.”

As with EPSLA, EFMLA has instructions for how employers should calculate the number of hours an employee with varying schedules should be paid for leave under EFMLA. For an employee with a schedule that varies from week to week, the employee is entitled to be paid based on the average number of hours the employee was scheduled per day over the six (6) month period prior to the date on which the employee takes the leave, including hours for which the employee took leave of any type. If the employee did not work over the six (6) month period, the number of hours of paid sick leave should be calculated as the reasonable expectation of the employee at the time of hiring of the average number of hours per day that the employee would normally be scheduled to work. Employees who have worked for less than six (6) months prior to the date of leave are entitled to be paid based on the employee’s reasonable expectation at hiring of the average number of hours the employee would normally be scheduled to work.

There is also a cap at $200 per day (and $10,000 in the aggregate) for paid leave under EFMLA, regardless of whether the leave is taken by a full-time or part-time employee.

Is the employer required to give notice to employees of leave available under EFMLA?

Yes, if the necessity for leave is foreseeable. In that case, Employers should provide notice to employees, as is practical, in the same manner as other FMLA leave notices. The current FMLA leave notice poster can be found here: https://www.dol.gov/agencies/whd/posters/fmla.

Is the employer required to restore the employee’s position after leave?

Yes. An employee is entitled to the same reinstatement rights as if the employee had taken normal FMLA leave. However, employers with fewer than twenty-five (25) employees are exempt from the reinstatement requirement if: (1) the position held by the employee taking leave does not exist due to economic conditions or other changes in operating conditions of the employer, (2) the employer makes a reasonable effort to reinstatement the employee to an equivalent position with similar pay and conditions of employment, and (3) the employer makes a reasonable effort to contact the employee about an equivalent position if such position becomes available within one (1) year after the employee attempts to return to work.

When do EFMLA requirements begin?

EFMLA requirements take effect not later than fifteen (15) days after the date of enactment. The President signed the legislation the evening of March 18, which means that EFMLA requirements become effective April 2.

When do the EFMLA requirements end?

EFMLA contains a sunset provision that terminates EFMLA requirements on December 31, 2020.

Tax Credits for Paid Sick Leave

Will employers be able to recover any sick leave paid to eligible employees under EPSLA and EFMLA?

Yes, in the form of refundable tax credits. Employers are entitled to a refundable payroll tax credit on the wages required to be paid to eligible employees under both EPSLA and EFMLA. The tax credit will be allowed against the employer portion of Social Security taxes. If the tax credit exceeds the taxes the employer owes, the employer will be reimbursed the remaining balance of the tax credit.

For EPSLA, if the employee is taking paid sick leave under reasons 1-3, the credit limit is $511 per day (with an aggregate limit of $5,110) and if the employee is taking paid sick leave under reasons 4-6, the credit limit is $200 per day (with an aggregate limit of $2,000). This tax credit may be claimed for no more than ten (10) calendar days of pay per employee.

For EFMLA, the credit limit is $200 per employee per day (with an aggregate limit up to $10,000 per employee).

SMALL BUSINESS EXEMPTION FOR NEW Paid Sick Leave AND EMERGENCY FAMILY MEDICAL LEAVE Requirements

SMALL BUSINESS EXEMPTION FOR NEW Paid Sick Leave AND EMERGENCY FAMILY MEDICAL LEAVE Requirements

U.S. Department of Labor (DOL) Clarifies Small Business Exemption for New Paid Sick Leave and Emergency Family Medical Leave Requirements

Effective April 1, 2020, the new paid sick leave and emergency family medical leave requirements under the Families First Coronavirus Response Act ("Family First Act") apply to employers with fewer than 500 employees. Although formal regulations have not been released, the Department of Labor ("DOL") has provided some limited information about which small businesses with fewer than 50 employees will be exempt from these new paid sick leave and emergency family medical leave requirements under the Families First Act.

According to the DOL's additional guidance just released on the DOL's website, a small business is exempt from the both the new paid sick leave and emergency family medical leave requirements under the Families First Act if: (a) the employer has fewer than 50 employees; (b) an employee requests leave because the child's school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons; and (c) an authorized officer of the business has determined that at least one of the following three conditions is satisfied:

The provision of paid sick leave or expanded family and medical leave would result in the small business's expenses and financial obligations exceeding available business revenues and cause the small business to cease operating at a minimal capacity;

The absence of the employee or employees requesting paid sick leave or expanded family and medical leave would entail a substantial risk to the financial health or operational capabilities of the small business because of their specialized skills, knowledge of the business, or responsibilities; or

There are not sufficient workers who are able, willing, and qualified, and who will be available at the time and place needed, to perform the labor or services provided by the employee or employees requesting paid sick leave or expanded family and medical leave, and these labor or services are needed for the small business to operate at a minimal capacity.

The additional guidance also notes that that small businesses electing this small business exemption, which only exempts providing paid sick leave and emergency family medical leave due to school or place of care closures or child care provider unavailability for COVID-19 related reasons, should carefully document the reasons that they meet the criteria for this exemption.

We expect the DOL to issue formal regulations any day now, which should provide additional clarity to the small business exemption under the Families First Act. Indeed, a footnote within the DOL's guidance directs employers to Department regulations expected during April. We will send out new e-blasts as soon as regulations become available. We will be here for you throughout this pandemic.

Stay safe.

To remain up-to-date, please be sure to regularly check our COVID-19 Legal Insights webpage.

THE CARES ACT: FINANCIAL ASSISTANCE PROGRAMS AVAILABLE TO CONTRACTORS

THE CARES ACT: FINANCIAL ASSISTANCE PROGRAMS AVAILABLE TO CONTRACTORS

PROGRAMS AVAILABLE TO PROVIDE FINANCIAL ASSISTANCE TO CONTRACTORS UNDER THE CARES ACT

The Coronavirus Aid, Relief and Economic Security (CARES) Act establishes several programs to provide financial assistance to businesses and individuals affected by the COVID-19 pandemic. Some of the measures which focus on small businesses and may be valuable to contractors are summarized here.

Paycheck Protection Program

The objective of this $349 billion program administered by the Small Business Administration (SBA) and the U.S. Treasury Department is to enable businesses with less than 500 employees to remain operational and keep employees on their payrolls by providing loans, including loans that can be 100% forgiven. To qualify for a paycheck protection loan the borrower is to make a good faith self-certification that the loan is necessary because of the economic uncertainty caused by COVID-19 and will be applied to maintain payroll and make required payments. No personal guarantee or collateral is required. Small businesses (less than 500 employees or meeting the applicable SBA industry size standard), sole proprietorships, independent contractors and self-employed individuals in business on February 15, 2020 are eligible.

The loan can be used for payroll costs (up to a $100,000 annual compensation cap per employee), health care benefits (including paid sick or medical leave and insurance premiums), rent and mortgage obligations, utility bills and interest on debt obligations incurred prior to February 15, 2020. “Payroll costs” include wages, salary, commissions, payments to independent contractors up to $100,000 annually, tips, vacation and leave pay, employee separation payments, health care benefits, retirement benefits, and state or local taxes assessed on employee compensation. “Payroll costs” do not include payroll taxes, any compensation for an employee whose principal residence is outside the US, or any qualified sick or medical leave for which a credit is received under the Families First Coronavirus Relief Act.

The Paycheck Protection Program is in effect until June 30, 2020 and loans can be made retroactive to February 15, 2020 to cover payroll or other covered expenses. The maximum loan amount is 2.5 times your average monthly “payroll costs” for the one-year period ending on the date of the loan up to $10 million. Paycheck Protection loans have a maturity of two (2) years and a fixed interest rate of 0.50%. The U.S. Treasury Department has announced that “all loan terms will be the same for everyone.” All payments are deferred for six (6) months, but interest will accrue. Prepayment, borrower and lender fees are waived. Neither the government nor leaders will charge small businesses any fees.

Loans can be obtained through private qualified SBA lenders and any federally insured depository institution or federally credit union participating in the program and are 100% guaranteed by the government. Lenders may begin processing loan application on April 3, 2020. Applications can be obtained on the U.S. Treasury website.

Forgiveness of Loans

Perhaps the most significant feature of the Paycheck Protection Program is that these loans are forgivable (on a tax-free basis) up to the sum of the payroll costs, mortgage interest or rent, and certain utility payments made by the employer during the 8-week period beginning on the date of the loan, PROVIDED that the employer does not reduce its workforce during the 8-week period (as compared to the prior year) and does not reduce the salary or wages paid to any employee who earns less than $100,000 per year by more than 25% during the 8-week period. If employers have already made staffing reductions, the Act permits a business to qualify for loan forgiveness if they re-hire the workforce back to pre-existing levels by June 30, 2020. Due to likely high subscription costs, the Treasury Department anticipates that not more than 25% of the forgiven amount may be for non-payroll costs.

Any portion of the loan which is not forgivable can be repaid over 2 years at a .50% interest rate. Some of the other generous provisions of these loans include waiver of the SBA personal guarantee requirements for loans up to $200,000, relaxed financial disclosures, and deferment of payment of principal and interest of up to one year.

Paycheck Protection Loans are available to any business with fewer than 500 employees, whether the business otherwise qualifies as a “small business” under SBA rules. The loan forgiveness feature transforms these loans into the equivalents of a grant from the government for businesses which commit to keeping the workforce employed.

Other SBA Loan Provisions

The CARES Act also expands existing SBA loan programs. The Economic Injury Disaster Loan program is expanded to include availability to all businesses with fewer than 500 employees and to sole proprietors and ESOPs. No personal guarantees will be required for any of these loans under $200,000 made prior to December 31, 2020. In addition, a new Emergency Grant is available to allow any business which has applied for a disaster loan to receive up to $10,000, and the grant is not required to repaid even if the loan is not approved. Other provisions include forgiveness of up to six (6) months of principal, interest and fees on existing SBA Section 7(a) loans. Also, the statutory limit on SBA Express loans has been raised from $350,000 to $1 million through December 31, 2020.

Employee Retention Tax Credit

Businesses that are forced to shut down or suspend operations due to COVID-19, but which continue to pay employees during that period, are entitled to a credit against the employer portion of Social Security payroll taxes. For wages paid after March 12, 2020 and before January 1, 2021, the credit equals 50% of “qualified wages” paid of $10,000 per employee. Therefore, the total maximum credit available is $5,000 per employee. The credit is refundable if it exceeds the business’s liability for payroll taxes.

Businesses are eligible for the credit if their operations were fully or partially suspended during any calendar quarter during 2020 due to orders from an appropriate government entity resulting from COVD-19. Alternatively, businesses that remained open but had gross receipts for any quarter in 202 that were 50% of what they were for the same quarter in 2019 are eligible for the credit for each quarter until the business has a quarter in which gross receipts exceed 80% of what they were for the same quarter in the previous year.

The definition of “qualified wages” depends on whether the employer has more than 100 full-time employees. For employers with more than 100 employees, qualified wages are those paid to employees when they are not providing services due to the COVID-19 outbreak. For businesses with 100 or fewer employees, all wages qualify. In general, qualified wages includes amounts paid to maintain group health insurance.

NOTE: This credit is not available to any business which takes out a Payroll Protection Loan as described above.

Deferral of Payroll and Self-Employment Taxes

The CARES Act allows employers to defer payment of the employer’s share of the 6.2% Social Security taxes owed. Those taxes which are owed between now and December 31, 2020 may be deferred, with 50% payable by December 31, 2021 and the other 50% payable by December 31, 2022. Self-employed taxpayers can defer 50% of their self-employment taxes due for the rest of 2020 in a similar fashion.

NOTE: This deferral is not available to any business which takes out a Payroll Protection Loan as described above.

Further Questions? The CARES Act also contains a number of technical corrections and tax provisions which are available for businesses and business owners. If you have further questions about the provisions discussed above or any other aspect of the CARES Act, please contact Scott Calhoun at sdc@hpsslaw.com.

STATE EXECUTIVE ORDERS: CONTINUATION OR SUSPENSION OF CONSTRUCTION DURING COVID-19

STATE EXECUTIVE ORDERS: CONTINUATION OR SUSPENSION OF CONSTRUCTION DURING COVID-19

State Executive Orders: Continuation or Suspension of Construction During COVID-19?

Throughout the United States, state and local governments continue to issue and update orders restricting activities of individuals and businesses in response to the COVID-19 pandemic. Generally, such orders provide exemptions from the restrictions for essential businesses, services and/or functions, and most states consider performance of construction an essential service. Pennsylvania, New York and Washington are exceptions, taking a much more restrictive approach limiting construction to only certain types of buildings and situations. Some local governments in California and elsewhere have also put some restrictions on construction.

This memorandum is intended to provide information and guidance with respect to orders issued by various state and local governments. Please keep in mind that this is a very fluid situation. State and local governments continue to issue and update orders, sometimes as frequently as hourly. We will continue to monitor the situation and update this information as quickly as possible, but please check with us or your state and local governments for the most updated information and restrictions.

Of course, the health and safety of employees is the highest priority for all contractors. Thus, as construction proceeds in many states, please ensure that you are following the latest guidelines issued by OSHA and the Centers for Disease Control (“CDC”) with respect to COVID-19 and safety and health in the workplace.

Federal Government

The Cybersecurity and Infrastructure Security Agency (“CISA”), a part of the U.S. Department of Homeland Security, released guidance on March 19, 2020, following up on President Trump’s March 16, 2020 updated Coronavirus Guidance for America. Many states refer to the CISA list of 16 critical infrastructure sectors in announcing state policy and determining what are essential activities that can continue. The CSA document identifies 16 critical infrastructure sectors. The CISA Guidance does, not reference construction specifically, but construction to support a critical infrastructure sector is implied. Included in the 16 critical infrastructure sectors are:

Commercial Facilities Sector

Critical Manufacturing Sector

Defense Industrial Base Sector

Energy Sector

Chemical Sector

Financial Services Sector

Government Facilities Sector

CISA states that its guidance is not binding and is intended to help inform decisions by state and local jurisdictions but does not compel prescriptive action. The list does not impose any mandates on state or local jurisdictions or private companies.

On March 28, 2020, CISA issued an “Advisory Memorandum on Identification of Essential Critical Infrastructure Workers During Covid-19 Response” and “Guidance on the Essential Critical Infrastructure Workforce.” The Advisory Memorandum includes workers engaged in maintaining and repairing critical infrastructure, working construction, public works, workers who support crucial supply chains and workers who enable functions for critical structures. Under the heading of Public Works and Infrastructure Support Services, CISA lists workers such as plumbers, electricians, exterminators, builders, contractors, HVAC technicians, landscapers and other service providers who provide services that are necessary to maintaining the safety, sanitation, and essential operation of residences, businesses and buildings such as hospitals, senior living facilities, and any temporary construction required to support COVID-19 response.

CISA emphasizes that its list of critical infrastructure sectors, workers and functions that should continue during COVID-19 response is advisory in nature and is not a federal directive or standard and is not intended as an exclusive list. Individual jurisdictions should add or subtract essential workforce categories based on their own requirements and discretion. Essential businesses that cannot work remotely are to use strategies to reduce the likelihood of spreading COVID-19 disease, including separating staff by off-setting shift hours or days and social distancing.

COVID-19 STATE

EXECUTIVE ORDERS

See below for state-by-state listing of whether construction may continue during the Coronavirus pandemic.

Alabama (updated APRIL 4, 2020)

Alabama issued a statewide stay-at-home order on April 3, 2020, effective at 5:00 p.m. on April 4, 2020, requiring every person to stay at his or her place of residence except as necessary to perform one of the enumerated “essential activities,” which include performing work at “essential businesses and operations” and performing essential work related activities. The order remains in effect until 5:00 p.m. on April 30, 2020.

Construction and construction-related services are identified in the Alabama order as an essential business and operation, including building and construction, lumber, building materials and hardware businesses, electricians, plumbers, other construction tradesmen and tradeswomen, exterminators; cleaning and janitorial, HVAC and water heating businesses; painting, moving and relocating services, other skilled trades, and other related construction firms and professionals for maintaining essential infrastructure.

Operators of “essential businesses and operations” may, but need not, issue credentials to their employees verifying their status as an employee of an essential business or operation. The decision to provide any such credentials is left to the discretion of the essential business or operation.

Essential businesses and operations shall take all reasonable steps for employees and customers to avoid gatherings of 10 persons or more and maintain a consistent six-foot distance between persons.

Arizona (updated APRIL 3, 2020)

On March 23, 2020, Governor Ducey issued an order prohibiting counties, cities and towns from making or issuing any order, rule or regulation that restricts or prohibits any person from performing an essential function. The order specifically includes construction as an Essential Infrastructure Operation, and it includes Building and Construction Tradesmen and Tradeswomen and other trades as Essential Businesses and Operations. Construction can continue, but the Governor’s March 30, 2020 Stay-At-Home Order (Executive Order 2020-18) requires construction business to “establish and implement social distancing and sanitation measures established by the United States Department of Labor or the Arizona Department of Health Services.” The March 30, 2020 updated recommendations of the Arizona Department of Health Services require essential businesses to “implement rules and procedures that facilitate physical distancing and spacing of individuals of at least 6 feet.”

California (updated APRIL 9, 2020)

Governor Newsome issued a statewide stay-at-home order on March 19, 2020. As outlined in the Order, construction workers are included as critical infrastructure workers. However, local jurisdictions have put in place their own orders, some of which are more restrictive than the state mandate.

Local Action:

San Francisco Area

The counties of Alameda, Contra Costa, Marin, San Francisco, San Mateo and Santa Clara, as well as the city of Berkeley have issued a revised stay at home order which is effective through May 3. Under the order, which by its terms is intended as a “complement” to the state-wide order, permissible activities are more limited.

“Essential Businesses” which are allowed to remain open and operating include Construction, but only of the types listed below:

Projects immediately necessary to the maintenance, operation, or repair of Essential Infrastructure;

Projects associated with Healthcare Operations, including creating or expanding Healthcare Operations, provided that such construction is directly related to the COVID-19 response;

Affordable housing that is or will be income-restricted, including multi-unit or mixed-use developments containing at least 10% income-restricted units;

Public works projects if specifically designated as an Essential Governmental Function by the lead governmental agency;

Shelters and temporary housing, but not including hotels or motels;

Projects immediately necessary to provide critical non-commercial services to individuals experiencing homelessness, elderly persons, persons who are economically disadvantaged, and persons with special needs;

Construction necessary to ensure that existing construction sites that must be shut down under this Order are left in a safe and secure manner, but only to the extent necessary to do so; and

Construction or repair necessary to ensure that residences and buildings containing Essential Businesses are safe, sanitary, or habitable to the extent such construction or repair cannot reasonably be delayed.

“Essential Infrastructure” is defined to include airports, utilities (including water, sewer, gas, and electrical), oil refining, roads and highways, public transportation, solid waste facilities (including collection, removal, disposal, and processing facilities), cemeteries, mortuaries, crematoriums, and telecommunications systems (including the provision of essential global, national, and local infrastructure for internet, computing services, business infrastructure, communications, and web-based services).

The text of the new order can be found here:

https://www.sccgov.org/sites/phd/DiseaseInformation/novel-coronavirus/Pages/order-health-officer-033120.aspx

Los Angeles County

Construction work is allowed to continue. Essential workers include construction workers who support the construction, operation, inspection, and maintenance of construction sites and construction projects, including but not limited to, public works construction, construction of commercial, office and institutional buildings, and construction of housing. However, the Los Angeles Department of Building and Safety has issued specific restrictions and guidelines on construction activity, including use of PPE, specific sanitizing requirements, and the presence of a site specific COVID-19 Supervisor to enforce the requirements. The full text of the guidelines can be found here: http://www.ladbs.org/our-organization/messaging/news

Colorado (updated March 24, 2020)

Governor Polis issued a statewide order, Executive Order D 2020 013, which requires employers to reduce their in-person work forces by fifty percent beginning on March 24, 2020 and continuing until April 10, 2020. The order directs the Colorado Department of Public Health and Environment (CDPHE) to issue a public health order defining critical infrastructure and other activities that are exempt from the directive of the Governor’s order. The order does not apply to “authorized businesses” that the public health order identifies as exempt from the Governor’s order, or “to any employer that can certify that employees are no closer than six feet from one another during any part of their work hours.”

The Public Health Order 20-24 issued by CDPHE provides that Critical Businesses are exempt from Executive Order D 2020 013 and are encouraged to remain open. Critical Businesses are required to “comply with guidance and directives for maintaining a clean and safe work environment issued by the Colorado Department of Health and Environment and any applicable local health requirement.” They are also “encouraged to comply with Social Distancing Requirements and all PHOs [Public Health Orders] currently in effect to the greatest extent possible.” Construction is listed as a Critical Business; therefore, construction can continue.

Connecticut (updated APRIL 2, 2020)

Governor Lamont’s March 20, 2020 Executive Order 7H, which required non-essential businesses to reduce their personnel at each business location by 100%, includes construction as an “essential business.” In accordance therewith, the Connecticut Department of Economic and Community Development issued a guidance document which stated that construction includes:

All skilled trades such as electricians, HVAC and plumbers

General construction, both commercial and residential

Other related construction firms and professionals for essential infrastructure or for emergency repair and safety purposes

Planning, engineering, design, bridge inspection, and other construction support activities

The essential businesses designated in the guidance are not subject to the in-person restrictions. Governor Lamont’s Executive Order 7N, issued on March 26, 2020, prohibited gatherings of six (6) or more people. The 6-person limitation does not apply to government operations, private workplaces, retail establishments, or other activities that are not social or recreational gatherings.

Governor Lamont’s Executive Order 7H stated that essential businesses include, but are not limited to, the 16 critical infrastructure sectors as defined by the Cybersecurity and Infrastructure Security Agency (CISA) of the U.S. Department of Homeland Security.

Executive Order 7V requires essential businesses to take additional protective measures issued by the Commissioner of Economic and Community Development. Those Rules for Essential Employers are available at: https://portal.ct.gov/DECD/Content/Coronavirus-Business-Recovery/Safe-Workplace-Rules-for-Essential-Employers. The rules are fairly extensive and include, among other things, specific social distancing and cleaning/disinfecting requirements. They also include the following rules that are specific to construction sites:

Clean portable bathrooms no less than every 2 days.

Require employees to travel separately to and from, and within, worksites.

Reschedule work to maximize the amount of work being performed outdoors, limit indoor or work lacking significant fresh air.

Shift work to limit the size of the crews on the jobsite, especially indoors.

Rotate lunch and coffee break shifts, requiring workers to follow the CDC social distancing guidelines during meals or breaks.

Follow all safety and health protocols when using an elevator.

Provide an adequate supply of PPE, including but not limited to cloth face masks, gloves, hand sanitizer or soap and water.

Florida (updated APRIL 3, 2020)

On April 1, 2020, Governor Ron DeSantis issued a state-wide stay-at-home Executive Order, which went into effect at 12:01 a.m. on April 3, 2020 and expires on April 30, 2020.

Pursuant to the stay-at-home order, senior citizens and individuals with significant underlying are required to stay at home and take all measures to limit risk of exposure to COVID-19. Further, all persons in Florida are required to limit their movements and personal interactions outside of their home to only those necessary to obtain essential services or conduct essential activities.

Florida defines “Essential Services” as:

The list detailed by the U.S. Department of Homeland Security in its Guidance on Essential Critical Infrastructure Workforce v. 2 (March 28, 2020); and,

The essential businesses set forth in Executive Order 20-89, which included the following construction-related essential business designations:

Contractors and other tradesman, appliance repair personnel, exterminators, and other service providers who provide services that are necessary to maintaining the safety, sanitation, and essential operations of residences and other structures;

Open construction sites, irrespective of the type of building; and

Architectural, engineering, or land surveying services.

Accordingly, construction is allowed to continue in Florida. Notably, the March 28, 2020 CISA Advisory Memorandum on Identification of Essential Critical Infrastructure Workers adopted by Florida includes individuals engaged in “maintaining and repairing critical infrastructure” and “working construction.” Essential Critical Infrastructure Workers include those working on Commercial Facilities and Government Facilities.

All prior executive orders relating to COVID-19 remain in effect in Florida. In general, prior orders that set forth restrictions not necessarily overridden by the stay at home order are:

Executive Order 20-80, which required all individuals that fly into Florida from states with substantial community spread, specifically including Connecticut, New Jersey, and New York, to self-isolate in Florida for the shorter of 14 days or the duration of their trip;

Executive Order 20-86, which required all individuals that drive into Florida from states with substantial community spread, specifically naming Louisiana, to self-isolate in Florida for the shorter of 14 days or the duration of their trip. However, this Order exempted any person engaged in “commercial activities”;

The Governor’s stay-at-home order supersedes any conflicting local action or order issued by local officials in response to COVID-19. Accordingly, the state-wide order governs.

Stay-At-Home Executive Order 20-91 found here:

https://www.flgov.com/wp-content/uploads/orders/2020/EO_20-91-compressed.pdf

Amendment clarifying local application via Executive Order 20-92 found here:

https://www.flgov.com/wp-content/uploads/orders/2020/EO_20-92.pdf

Georgia (updated APRIL 3, 2020)

On April 2, 2020, Governor Kemp issued a statewide shelter-in-place order effective at 6:00 p.m. on Friday, April 3, 2020 and expiring at 11:59 p.m. on Monday, April 13, 2020. All residents and visitors to Georgia are required to remain in their place of residence and take every possible precaution to limit social interaction, unless they are:

Conducting or participating in Essential Services.

Performing Necessary Travel.

Are engaged in the performance of, or travel to and from, the performance of Minimum Basic Operations for a business, establishment, corporation, non-profit corporation, or organization not classified as Critical Infrastructure; or

Are part of the workforce for Critical Infrastructure and are actively engaged in the performance of, or travel to and from, their respective employment.

Construction is allowed to continue in Georgia. Georgia follows the definition of “Critical Infrastructure” and “essential critical infrastructure workforce” as defined in the March 19, 2020 and March 28, 2020 guidance memoranda issued by the Cybersecurity and Infrastructure Security Agency (“CISA”) of the U.S. Department of Homeland Security. The March 28, 2020 CISA Advisory Memorandum on Identification of Essential Critical Infrastructure Workers includes individuals engaged in “maintaining and repairing critical infrastructure” and “working construction.” Essential Critical Infrastructure Workers includes those working on Commercial Facilities and Government Facilities.

Critical Infrastructure businesses that continue in operation are to implement measures which mitigate the exposure and spread of COVID-19 among its workforce. Such measures may include, but are not limited to:

Screening and evaluating workers who exhibit signs of illness, such as a fever over 100.4 Fahrenheit, cough, or shortness of breath;

Requiring workers who exhibit signs of illness to not report to work or to seek medical attention;

Enhancing sanitation of the workplace as appropriate;

Requiring hand washing or sanitation by workers at appropriate places within the business location;

Providing personal protective equipment as available and appropriate to the function and location of the workers within the business location;

Prohibiting gatherings of workers during working hours;

Permitting workers to take breaks and lunch outside, in their office or personal workspace, or in such other areas where proper social distancing is attainable;

Implementing teleworking for all possible workers;

Implementing staggered shifts for all possible workers;

Holding all meetings and conferences virtually, whenever possible;

Delivering intangible services remotely wherever possible;

Discouraging workers from using other workers’ phones, desks, offices, or other work tools and equipment;

Prohibiting handshaking and other unnecessary person-to-person contact in the workplace;

Placing notices that encourage hand hygiene at the entrance to the workplace and in other workplace areas where they are likely to be seen;

Providing disinfectant and sanitation products for workers to clean their workspace, equipment, and tools; and

Increasing physical space between workers’ worksites to at least six (6) feet.

The Order states that operation of Critical Infrastructure shall not be impeded by county, municipal, or local ordinance. The Georgia Department of Economic Development is authorized to give guidance to any business, corporation, organization, or industry trade group regarding its status as Critical Infrastructure.

No business, establishment, corporation, non-profit corporation, organization, or county or municipal government shall allow more than ten (10) persons to be gathered at a single location if such gathering requires persons to stand or be seated within six (6) feet of any other person.

Any person who violates the Order shall be guilty of a misdemeanor. Officials enforcing the Order should take reasonable steps to provide notice prior to issuing a citation of making an arrest.

Governor Kemp’s prior executive order of March 14, 2020 allows contractors to retain “private professional providers” to perform plan review and inspection services pursuant to O.C.G.A. §8-2-26(g)(5) immediately. This executive action would allow construction projects to continue to meet inspection requirements in situations where a local jurisdiction ceases providing inspection services due to COVID-19.

The Governor’s shelter-in-place order supersedes any conflicting local action or order issued by local officials in response to COVID-19. Accordingly, the state-wide order governs.

Shelter-in-Place Executive Order found here:

https://gov.georgia.gov/document/2020-executive-order/04022001/download

Illinois (updated APRIL 3, 2020)

Governor J.B. Pritzker issued a stay-at-home order on March 20, 2020. Construction is expressly included within the definition of Essential Infrastructure. The Illinois order also expressly provides that “Essential Infrastructure” is to be broadly defined. The Illinois order currently extends through April 30, 2020.

Indiana (updated March 23, 2020)

Most recent Executive Order issued by Governor on March 24, 2020, effective as of 11:59 pm on March 24, 2020. All individuals are ordered to stay at home, except as allowed in this Executive Order. Must maintain 6’ distancing. May leave homes for Essential Activities, Essential Government Functions or to participate in Essential Businesses and Operations. Construction is listed as an Essential Infrastructure activity.

All Essential Businesses and Operations are encouraged to remain open and shall comply with the Social Distancing Requirements, including maintaining 6’ social distancing for both employees and members of the general public at all times.

Individuals may leave their homes for:

Health and Safety

Necessary Supplies and Services

For Outdoor Activity

For Certain Types of Work

To perform work providing essential products and services at Essential Businesses or Operations, which includes Essential Governmental Functions and Essential Infrastructure.

Essential Infrastructure:

Individuals may leave their homes in order to provide services or perform work to offer, provision, operate, maintain and repair Essential Infrastructure.

Essential infrastructure includes, but is not limited to, distribution, construction (including but not limited to construction related to this public health emergency, hospital construction, essential business construction and housing construction), building management and maintenance.

The phrase “Essential Infrastructure” shall be broadly construed in order to avoid any impacts to essential infrastructure, broadly defined.

Louisiana (updated March 29, 2020)

Governor Edwards issued a statewide stay-at-home order that went into effect at 5 pm on Monday March 23, 2020. Stay-at-home order does not include essential workers. Guidance issued March 22, 2020 lists construction as essential infrastructure.

Maryland (updated APRIL 2, 2020)

Governor Hogan issued a stay-at-home Executive Order on March 30, 2020 effective at 8:00 p.m. on March 30th. The Order did not change what businesses are deemed essential or nonessential. Commercial and residential construction can continue in Maryland. Maryland follows the federal guidance published by the Cybersecurity and Infrastructure Security Agency (CISA) of the U.S. Department of Homeland Security pertaining to essential businesses - currently described at https://cisa.gov/identifying-critical-infrastructure-during-covid-19. The Maryland Office of Legal Counsel issued Interpretative Guidance pertaining to Governor Hogan’s March 23, 2020 Executive Order which prohibited large gatherings and required closing of non-essential businesses and other establishments. The Interpretive Guidance states specifically under the Commercial Facilities Sector (which is one of the 16 essential sectors identified in the CISA guidance) that the sector includes: “building and property maintenance companies, including without HVAC service companies roofers, environmental services companies, exterminators, arborists, and landscapers” and “commercial and residential construction companies.”

Essential businesses are allowed to remain open and must make every effort to scale down their operations to reduce the number of required staff, to limit interactions with customers, and to institute telework for as much of the workforce as practical. Non-essential businesses are closed to the general public as of 5:00 pm on March 23, 2020. Gatherings of more than 10 people are prohibited. Governor Hogan’s Executive Order remains in effective until rescinded or superseded.

Maryland has a COVID-19 Layoff Aversion Fund and small business relief fund. Information about these programs is available at businessexpress.maryland.gov.

Massachusetts (updated APRIL 2, 2020)

Governor Baker’s March 23, 2020 Emergency Order on Essential Services, updated on March 31, 2020, lists businesses that provide essential services and workforces. The list of essential services under Construction-Related Activities includes:

Workers such as plumbers, electricians, exterminators, builders, contractors, HVAC technicians, landscapers, inspectors and other service providers who provide services that are necessary to maintaining the safety, sanitation and essential operation of residences, businesses and buildings such as hospitals, health care facilities, senior living facilities, and any temporary construction required to support COVID-19 response.

Workers -including contracted vendors - who support the operation, inspection and maintenance and repair of essential public works facilities and operations, including construction of critical or strategic infrastructure. Critical or strategic infrastructure includes public works construction, including construction of public schools, colleges and universities and construction of state facilities.

Workers performing housing construction related activities, including construction of mixed-use projects that include housing.

Workers supporting the construction of housing, including those supporting government function related to the building and development process, such as inspections, permitting and plan review services

Governor Baker’s order supersedes and renders inoperative any order or rule issued by a municipality that will or might in any way impede or interfere with the objectives of the Governor’s Order, including any order or rule issued by a municipality that would interfere with ensuring the continued operation of COVID-19 Essential Services. Boston Mayor Martin Walsh ordered the halt of all but essential construction work in Boston (see below). It would seem that the Governor’s Order supersedes the Boston Mayor’s prior order shutting down non-essential construction sites in Boston.

All businesses and organizations that do not provide COVID-19 Essential Services are required to close their physical workplaces and facilities to workers, customers and the public. These businesses are encouraged to continue operations remotely. Gov. Baker’s order remains in effect until May 4, 2020.

On March 31, 2020, the Massachusetts Building Trades Council asked Governor Baker to suspend all non-emergency and non-essential construction work statewide from April 3rd through April 30th. The North Atlantic States Regional United Brotherhood of Carpenters has directed is members to ceasing working in Massachusetts on all construction site other than health care facilities, effective April 6, 2020, until it is safe to do so.

Local Action:

Boston

As of March 17, 2020, the City suspended all regular activity at construction sites. New regular projects cannot be started unless they qualify as essential work. After sites have been secured by March 23, 2020, skeleton crews will be permitted for the remainder of the suspension to ensure safety. The only work that will be permitted is emergency work, which needs to be approved by the City of Boston’s Inspectional Services Department. Essential work includes emergency utility, road or building work such as gas leaks and water leaks, mandated building or utility work, work at public health facilities and shelters, and other work necessary to render occupied residential buildings fully habitable.

In addition to the list of essential construction projects, the City will, on a case-by-case basis, review requests for exceptions to the temporary construction moratorium. These may be granted by the Commissioner of Inspectional Services for building-related work. These will be granted if they support increased public health and safety.

Michigan (updated APRIL 9, 2020)

Governor Whitmer issued a statewide stay-at-home order on March 23, 2020, which becomes effective at 12:01 a.m. on Tuesday, March 24, 2020 and has been extended through April 30, 2020. The order specifically references the CISA guidelines issued on March 19, 2020 in reference to essential infrastructure (and specifically NOT any further guidance issued by CISA), but there is no specific reference to construction activities.

Minnesota (updated March 29, 2020)

Gov. Walz issued an Executive Order on March 25, 2020, effective at 11:59 p.m. on March 27, 2020 and extending to 5 p.m. on April 10, 2020, ordering all persons currently living in Minnesota to stay at home except to engage in exempt activities and Critical Sector work. All workers who can work from home must do so. Workers who perform work that cannot be done at their home and can be done only at a place of work outside of their home are exempt if their work is listed under Exemptions – Critical Sectors.

Construction and critical trades, including workers in the skilled trades such as electricians, plumbers, HVAC and elevator technicians, and other related construction of all kind, are explicitly identified as a critical service exemption in the governor’s order. The critical services exemptions apply only to travel to and from an individual’s residence and place of work and an individual’s performance of work duties that cannot be done at home. Travel may include transportation to and from childcare or school settings as necessary to ensure the safe care of children.

Missouri (updated APRIL 6, 2020)

Effective April 6, 2020 and until April 24, 2020, the Missouri Department of Health and Senior Services has issued a statewide stay at home order. The order provides that “any entity that does not employ individuals to perform essential worker functions, as set forth in guidance provided by CISA shall adhere to the limitations on social gatherings and social distancing” specified in the order. Because the order applies the CISA guidelines, construction work is permitted. Gatherings are limited to 10 people or less and all workers and others at any gathering must maintain a social distance of six feet or more. The state-wide order does not limit the right of local authorities to make such further ordinances, rules, regulations, and orders not inconsistent with the Order which may be necessary for the particular locality under the jurisdiction of such local authorities.

Local Action:

The following cities and counties have issued stay at home orders. Definitions and specifics related to the construction industry vary by local jurisdiction.

Kansas City

“Essential Infrastructure” shall mean to include, but not be limited to, public works construction, construction of housing, airport operations, water, sewer, gas, electrical, oil refining, railroad and rail systems, roads and highways, public transportation, solid waste collection and removal, internet, and telecommunications systems (including the provision of essential infrastructure for computing services, business infrastructure, communications, and web-based services).

Jackson County (Kansas City area)

Essential Infrastructure includes, but is not limited to, public works construction, construction of housing (in particular affordable housing or housing for individuals experiencing homelessness), airport operations, water, sewer, gas, electrical, oil refining, roads and highways, public transportation, solid waste collection and removal, internet, and telecommunications systems (including the provision of essential global, national, and local infrastructure for computing services, business infrastructure, communications, and web-based services).

St. Louis (including St. Louis County, Jefferson County, and Perry County)

Construction is either exempt from the stay at home restrictions or is deemed an Essential Activity (in Perry County).

Branson

Construction is specifically designated as an Essential Business by the city’s Emergency Management Director and so is permitted.

Cass County, Clay County, Jackson County, Platte County, and Ray County

In each of these counties, plumbers and electricians fall within the definition of Essential Business. Public works construction and housing construction are included within the definition of Essential Infrastructure. Other construction activity falls within the stay at home orders.

Cole County, Randolph County, and the City of Columbia

In each of these jurisdictions, construction is included as an Essential Activity and so is permitted.

Springfield-Greene County

Construction is included with the definition Essential Business and so is permitted.

Montana (updated APRIL 6, 2020)

Gov. Bullock issued an Executive Order on March 26, 2020 directing all individuals to stay at home to the greatest extent possible. Persons may leave their homes only for Essential Activities or to operate Essential Businesses and Operations, which includes Essential Infrastructure. Individuals may leave their residence to perform work to provide, maintain or repair Essential Infrastructure which includes construction, including housing construction. The governor’s order includes “Critical trades” under “Essential Businesses and Operations” and lists, among others, building and construction tradesmen and tradeswomen, and other trades including but not limited to plumbers, electricians, exterminators, operating engineers, HVAC, painting and other service providers who provide services that are necessary to maintaining the safety, sanitation and essential operation of residences, Essential Activities and Essential Businesses and Operations.

The governor’s order defines Essential Businesses and Operations to encompass the workers identified in the Cybersecurity & Infrastructure Security Agency March 19, 2020 Memorandum on Identification of Essential Critical Infrastructure Workers During COVID-19 Response, available at https://www.cisa.gov/publication/guidance-essential-critical-infrastructure-workforce.

Essential Infrastructure is to be construed broadly.

New Jersey (updated APRIL 10, 2020)

Executive Order 122 (available at https://nj.gov/infobank/eo/056murphy/pdf/EO-122.pdf) requires the physical operations of all non-essential construction projects to cease effective April 10, 2020 at 8:00 pm. “Essential construction projects” that may continue, provided they adopt policies with certain minimum requirements, are defined as follows:

a. Projects necessary for the delivery of health care services, including but not limited to hospitals, other health care facilities, and pharmaceutical manufacturing facilities;

b. Transportation projects, including roads, bridges, and mass transit facilities or physical infrastructure, including work done at airports or seaports;

c. Utility projects, including those necessary for energy and electricity production and transmission, and any decommissioning of facilities used for electricity generation;

d. Residential projects that are exclusively designated as affordable housing;

e. Projects involving pre-K-12 schools, including but not limited to projects in Schools Development Authority districts, and projects involving higher education facilities;

f. Projects already underway involving individual single-family homes, or an individual apartment unit where an individual already resides, with a construction crew of 5 or fewer individuals. This includes additions to single-family homes such as solar panels;

g. Projects already underway involving a residential unit for which a tenant or buyer has already entered into a legally binding agreement to occupy the unit by a certain date, and construction is necessary to ensure the unit’s availability by that date;

h. Projects involving facilities at which any one or more of the following takes place: the manufacture, distribution, storage, or servicing of goods or products that are sold by online retail businesses or essential retail businesses, as defined by Executive Order No. 107 (2020) and subsequent Administrative Orders adopted pursuant to that Order;

i. Projects involving data centers or facilities that are critical to a business’s ability to function;

j. Projects necessary for the delivery of essential social services, including homeless shelters;

k. Any project necessary to support law enforcement agencies or first responder units in their response to the COVID-19 emergency;

l. Any project that is ordered or contracted for by Federal, State, county, or municipal government, or any project that must be completed to meet a deadline established by the Federal government;